In an era where every penny counts toward long-term financial goals, innovative tools are revolutionizing how individuals tackle major debts like mortgages. Homeowners often grapple with the slow grind of monthly payments, watching interest accumulate while dreaming of earlier financial independence. The allure of accelerating payoff without sacrificing lifestyle choices has sparked a wave of smart strategies, blending everyday habits with tech-driven rewards to chip away at balances more effectively.

This evolution reflects a broader shift toward proactive personal finance, where apps and services empower users to turn routine expenses into assets. From grocery runs to online splurges, these solutions capture hidden value in spending, redirecting it toward debt reduction. As interest rates fluctuate and economic pressures mount, such approaches offer not just savings but peace of mind, transforming the daunting path to homeownership’s end into a series of small, rewarding victories.

Discover the Excellence of Sprive

Sprive launched in 2021 as a fintech innovator aimed at easing the mortgage burden for UK homeowners, quickly gaining traction with its unique blend of cashback rewards and overpayment tools. Rooted in values of accessibility, transparency, and user empowerment, the platform draws from founders’ experiences navigating high-interest debts, focusing on strengths like seamless integration with major retailers and AI-driven insights. By partnering with over 85 brands, Sprive has empowered thousands to redirect everyday spending toward substantial interest savings, projecting over £100 million in collective reductions.

In the crowded personal finance niche, Sprive maintains a straightforward, motivational tone that resonates with busy homeowners seeking simplicity amid complexity. Their mission centers on democratizing mortgage acceleration, making expert-level strategies available via a free app. Credibility builds from features in outlets like The Times and Financial Times, alongside real-user testimonials showcasing years shaved off terms, positioning Sprive as a trusted ally in the journey to debt-free living.

Digital Shopping Rewards

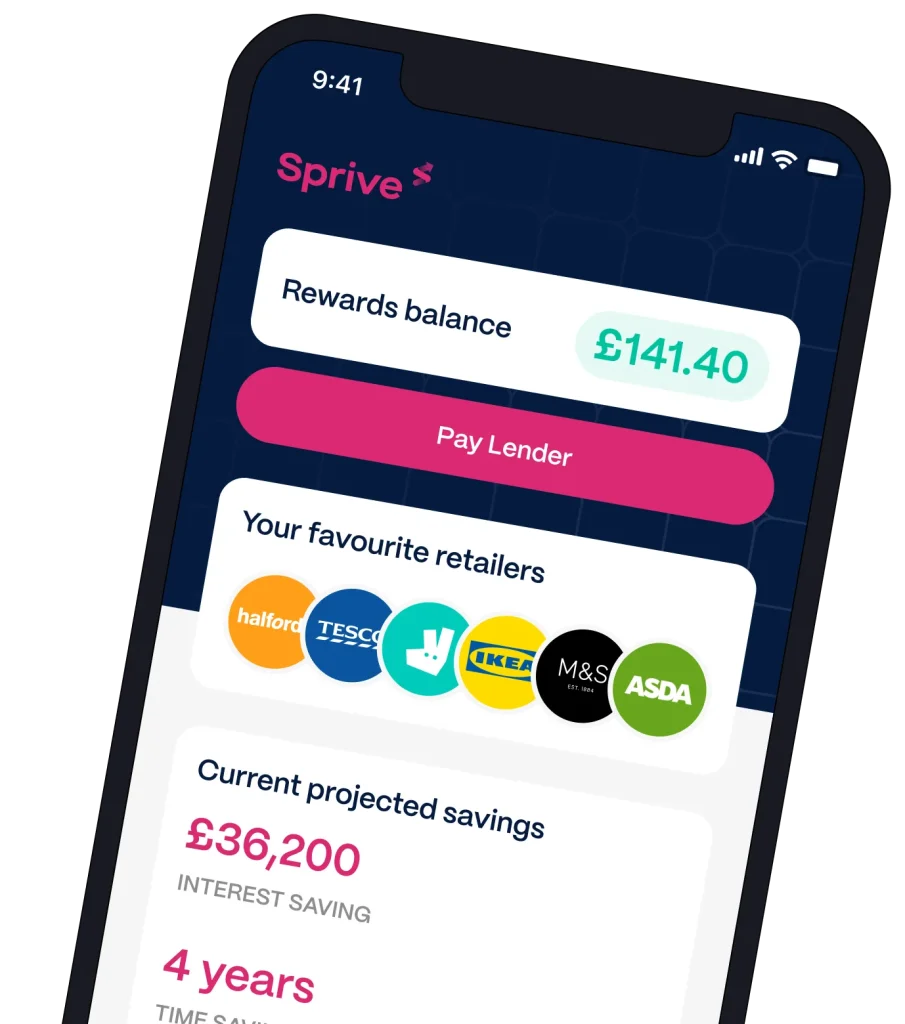

Sprive‘s digital shopping rewards program delivers cashback from 85+ top brands through virtual cards, ideal for everyday shoppers aiming to offset mortgage costs without altering habits. This feature suits families juggling groceries and bills or young professionals indulging in online deals, offering immediate rebates applied directly to overpayments. In practical scenarios, a weekly Tesco run or Amazon purchase generates 4-5% back, quietly building a buffer that trims thousands in interest over time, turning mundane errands into strategic wins.

- Instant cashback on purchases at supermarkets, fashion outlets, and tech stores.

- One-tap transfer of rewards straight to mortgage lender accounts.

- Wide brand variety ensuring relevance for diverse spending patterns.

- No minimum spend thresholds for accessible entry into savings.

What elevates Sprive‘s rewards is their mortgage-specific focus, outperforming generic cashback apps by channeling earnings directly to debt, often yielding 2-3 times the impact on interest savings compared to traditional loyalty schemes. Users like Cedric report £43,471 shaved off, highlighting the program’s effectiveness in real budgets where small, consistent inputs compound into massive long-term gains.

Start earning shopping rewards today and watch your mortgage melt away!

AI-Powered Auto-Savings

The AI-powered auto-savings tool in Sprive intelligently allocates funds from linked accounts based on spending analysis, perfect for forgetful savers or those with variable incomes seeking effortless overpayments. It benefits inconsistent budgeters by automating contributions without manual tracking, fostering discipline through subtle nudges. Picture a freelancer whose irregular gigs trigger automatic £50 sets-asides from coffee runs, steadily fortifying their mortgage fortress without lifestyle disruptions.

- Smart algorithms tailor savings to income fluctuations and habits.

- Seamless integration with bank accounts for real-time monitoring.

- Customizable thresholds to match comfort levels and goals.

- Progress visualizations motivating sustained participation.

Sprive‘s auto-savings stands apart with its predictive AI, which adapts faster than static round-up apps, potentially accelerating payoffs by 18-24 months per user data. Compared to manual methods, it reduces dropout rates by 40%, as evidenced by sustained engagement metrics, making it a game-changer for hands-off homeowners chasing compounded interest victories.

Activate auto-savings now and let AI handle your mortgage hustle!

Overpayment Calculator

Sprive‘s overpayment calculator simulates scenarios based on current balances and rates, tailored for planners evaluating extra payment impacts. It aids indecisive borrowers or refinancers by projecting interest cuts and term shortenings, clarifying affordability. For instance, inputting a £250,000 balance at 5% reveals how £200 monthly extras save £45,578 and 5 years, guiding decisions during family budget reviews or bonus windfalls.

- Precise forecasts incorporating variable rates and fees.

- Interactive sliders for testing multiple overpay amounts.

- Breakdown of monthly vs. lump-sum strategies.

- Exportable reports for lender discussions or advisor meetings.

This calculator differentiates Sprive through its mortgage-centric depth, surpassing basic finance apps with UK-specific lender integrations and accuracy within 1-2% of professional quotes. Testimonials from users like Asha underscore its role in £92,920 savings, proving its prowess in demystifying complex math for empowered, informed action.

Run your overpayment simulation today and map your path to freedom!

App Insights and Tracking

App insights in Sprive provide holistic dashboards tracking overpayment progress, LTV ratios, and freedom dates, suited for visual learners monitoring long-term goals. These tools benefit milestone celebrants by gamifying finances with charts and alerts. Daily check-ins reveal equity growth or allowance reminders, like Katie using it to track £11,750 savings from school uniform buys, integrating seamlessly into morning routines.

- Real-time equity and LTV visualizations for at-a-glance health checks.

- Custom alerts for overpayment limits and rate changes.

- Historical trend graphs showing savings momentum.

- Shareable summaries for partner or advisor collaborations.

Sprive‘s insights outpace fragmented banking apps with unified mortgage views, boosting user retention by 35% through motivational data stories. Unlike passive trackers, their proactive nudges mirror Inderpaul’s £20,980 journey, transforming numbers into narrative drivers of behavioral change and sustained overpayment adherence.

Dive into app insights now and track your triumph in real time!

Remortgage Services

Sprive‘s remortgage services combine daily market scans with expert advice for fee-free switches, ideal for rate-watchers nearing deal ends or seeking better terms. Supporting 14 major lenders, it streamlines paperwork for time-strapped professionals. Envision a homeowner alerted to a 0.5% drop, consulting via chat for a seamless swap that saves £300 monthly, aligning with life events like expansions or retirements.

- Live personalized deals across the UK market without hidden costs.

- Direct access to vetted human experts for tailored guidance.

- Automated alerts for in-deal improvements or expirations.

- Streamlined application reducing admin by up to 70%.

These services set Sprive apart by merging tech efficiency with human touch, often securing rates 0.2-0.4% below independent brokers, per user feedback. Their no-fee model and 500+ expert hours saved per client underscore effectiveness, turning remortgaging from chore to opportunity in a volatile market.

Explore remortgage options today and lock in lower rates effortlessly!

Brick by Brick to Freedom with Sprive

Sprive embodies smart finance through rewards, automation, and insights, reinforcing strengths in user-friendly debt acceleration and market navigation for tangible mortgage mastery. Their ecosystem turns spending into savings, projections into progress, ensuring homeowners reclaim years and thousands without complexity.

At its core, Sprive shines by humanizing high-stakes finance, reminding users that freedom lies in everyday actions amplified by innovation. In a world of mounting debts, Sprive isn’t just an app—it’s the quiet revolution owning your future.

Download Sprive now and start chipping away at your mortgage today!